India’s leading IT services company, Tata Consultancy Services (TCS), found itself in the spotlight on March 18, as its shares experienced a significant decline amidst rumors that its parent company and major shareholder, Tata Sons, is considering selling a portion of its stake in the firm.

According to unconfirmed market reports, Tata Sons, the holding company of the Tata Group conglomerate, is exploring the possibility of offloading up to 2.3 crore shares in TCS, representing a 0.64% stake.

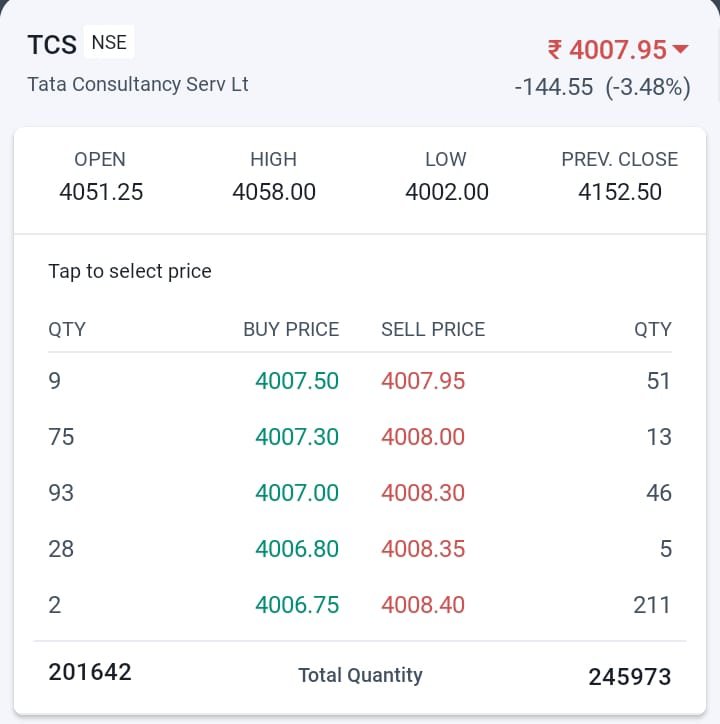

The rumored offer price for this substantial block deal is said to be around ₹4,001 per share, reflecting a notable 3.45% discount compared to TCS’s closing price on the previous trading day.

TCS Shares Nosedive Nearly 2%

As news of the potential stake sale by Tata Sons spread like wildfire, TCS’s shares reacted sharply, declining by nearly 2% in a single trading session.

The stock price plummeted to ₹4,144.25 on the National Stock Exchange (NSE) and ₹4,144.75 on the Bombay Stock Exchange (BSE).

Interestingly, earlier in the day, TCS shares had touched their 52-week high of ₹4,254.75 (NSE) and ₹4,254.45 (BSE), before the rumor mill sent them into a tailspin.

If the rumored block deal materializes at the speculated offer price, the total transaction value would amount to a staggering ₹9,202 crore (approximately $1.1 billion).

This sizeable transaction has undoubtedly caught the attention of investors and market analysts alike, as they scramble to assess the potential implications for TCS and the broader IT sector.

Tata Sons’ Shareholding in TCS

As of December 2023, Tata Sons and its promoter group entities held a substantial 72.41% stake in TCS, with Tata Sons alone owning a commanding 72.38% of the shareholding.

This tight grip on the company’s ownership has fueled speculation about Tata Sons’ strategic intentions and the rationale behind the rumored stake sale.

While the specific reasons behind Tata Sons’ decision to sell a stake in TCS remain undisclosed, the move could be related to a report from the renowned research firm Spark Capital in March.

The report suggested that Tata Sons, the apex holding company of the Tata Group, might go public by September 2025 to meet the Reserve Bank of India’s (RBI) scale-based regulations. These regulations mandate that upper-layer Non-Banking Financial Companies (NBFCs) are required to list on stock exchanges within three years of attaining a certain size threshold.

If the report’s predictions hold true, Tata Sons’ potential initial public offering (IPO) could be one of the largest in India’s corporate history, given the conglomerate’s vast business empire spanning multiple sectors, including automobiles, steel, power, and consumer goods, among others as of now.

Tata Sons’ Rationale: Raising Funds or Strategic Shift?

While the rumored stake sale in TCS could be a strategic move to comply with regulatory requirements, some industry experts speculate that Tata Sons might be exploring alternative options to raise funds. The conglomerate has been actively pursuing growth opportunities across various business verticals, and a cash infusion from the TCS stake sale could provide the necessary financial muscle for future investments or acquisitions.

Moreover, the stake sale could also be interpreted as a strategic shift in Tata Sons’ approach to managing its diverse portfolio of companies. By potentially reducing its holding in TCS, the conglomerate might be seeking to rebalance its investments and allocate resources more efficiently across its various businesses.

TCS: A Powerhouse in the Indian IT Sector

TCS, with a market valuation of nearly ₹15 lakh crore (approximately $180 billion), is the second most valuable firm in India after Reliance Industries Ltd. The IT behemoth has consistently delivered strong financial performance and is renowned for its quality management practices, making it a crown jewel in the Tata Group’s portfolio.

Over the years, TCS has solidified its position as a global leader in the IT services and consulting industry, serving a diverse range of clients across various sectors. The company’s robust business model, continuous innovation, and commitment to delivering value to its stakeholders have earned it a prominent place in the Indian corporate landscape.

TCS’s Financial Prowess

TCS’s financial performance has been nothing short of impressive, with the company consistently reporting strong revenue growth and profitability. In the recent quarter ended December 2023, TCS recorded a consolidated net profit of ₹11,238 crore, representing a year-over-year growth of 11.4%. The company’s revenue for the same period stood at ₹58,229 crore, a significant increase of 19.1% compared to the corresponding quarter in the previous fiscal year.

TCS’s robust financial metrics and consistent performance have contributed to its strong market position and investor confidence. However, the recent share price decline triggered by the stake sale rumors has raised eyebrows, as investors weigh the potential impact on the company’s future prospects and valuation.

As the market digests the implications of the rumored stake sale, investor sentiments have been mixed. While some view the move as a strategic decision by Tata Sons to comply with regulatory requirements or raise funds for future endeavors, others are concerned about the potential dilution of the company’s ownership structure and its impact on corporate governance.

Industry analysts and market experts have offered varying perspectives on the situation. Some believe that the stake sale, if executed, could lead to a temporary dip in TCS’s share price, but the company’s strong fundamentals and market leadership position should eventually offset any negative impact.

Others, however, express concerns about the potential implications of Tata Sons reducing its holding in TCS. They argue that a decrease in the parent company’s stake could potentially weaken its influence over the IT giant’s strategic direction and decision-making processes.

Corporate governance experts have also weighed in on the matter, highlighting the importance of maintaining transparency and ensuring that the interests of minority shareholders are protected. While Tata Sons has long been regarded as a responsible and ethical corporate entity, some analysts have emphasized the need for clear communication and adherence to best practices during the rumored stake sale process.

Also Read: India’s Trade Triumph: Exports Skyrocket to Historic $41.4 Billion in February

Comments 1