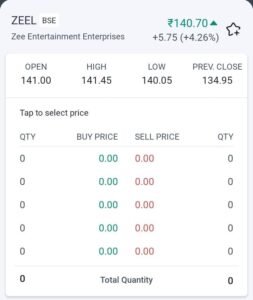

Zee Entertainment’s stock price rose as much as 5% in a special trading session on May 18, as the company’s profit turned profitable in the January-March quarter (4QFY24), with a per share 141 rupees.

Announcing it on 17th May, Zee Entertainment posted a net profit of Rs 13.3 million in Q4FY24, compared to a consolidated net loss of Rs 196 million in the year-ago period.

Zee Entertainment expects a revival in advertising spend on FMCG (Fast Moving Consumer Goods) and a strong monsoon season to propel its growth trajectory in the next FY25

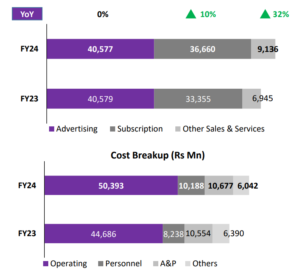

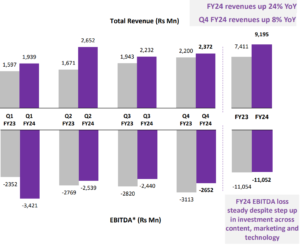

Advertising revenue was under pressure in the previous financial year, but there was some recovery in the March quarter, Zee stated.

“FY24 continued to be weak due to headwinds in the macroeconomic environment and other external factors. However, the last quarter of the financial year witnessed positive growth and we expect the momentum to continue in the new financial year,” said Punit, Managing Director and CEO of the company.

Goenka said during the fourth quarter conference call. He said the FMCG sector has recovered and rural sentiment has also improved, resulting in a significant increase in advertising revenue quarter-on-quarter and year-on-year.

Zee Entertainment: Key Factors growth in FMCG

FMCG companies are companies that manufacture and sell everyday consumer goods that are purchased frequently. These products typically have a relatively short shelf life and are consumed quickly.

Zee Entertainment expects FMCG companies to increase their advertising budgets in FY25. This is because FMCG companies rely on reaching a wide audience to promote their products, and television advertising is a significant channel for them.

The FMCG company is a key factor for Zee Entertainment’s growth in FY25 and its advertising spend decisions and dependence on consumer spending will have a significant impact on Zee’s advertising revenue.

Zee Entertainment’s profit in Q4

The company’s consolidated gross profit for the fourth quarter of FY2024 increased by 3.3% year-on-year to Rs 13.35 crore. Total expenses for the fourth quarter were Rs 2,043.76 million, lower compared to the same period last year (Rs 2,083.35 million). The company had reported a loss of ₹196.01 crore in the same period of the previous fiscal year.

The Board of Directors also recommended a final dividend for 2024 of $1 per share with a face value of R$1, subject to shareholder approval at a general meeting.

Zee Entertainment Enterprises reported a net profit of Rs Rs 13.35 crore for the quarter ended March 2024, compared to a loss of Rs 196 crore in the same quarter in 2023.

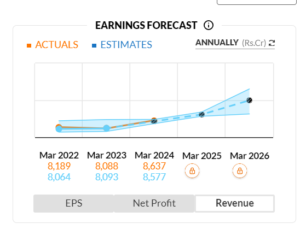

Moving into the second part of FY25, the company predicts that profits will slowly get better. It believes that by the end of 2025, the profit will be a lot better than it was in 2024.

Subscription Revenue to Increase

Goenka said that advertising spending was on the rise in April and May.

The CEO also stated “Subscription revenue has also continued to grow at a steady pace, going forward the focus of the players across the industry will be on identifying the avenues to grow the pay TV ecosystem in a healthy manner. We remain hopeful that NTO 3.0 implementation and tariff growth will strengthen the pay TV ecosystem and pave way for sustained growth in subscription revenue.”

The number of pay-TV households last year fell to 118 million from 120 million the previous year.

This is according to Ernst & Young’s (EY) 2024 report, which blames the decline on cord-cutting and the shift to connected TV at the top end of the market, as well as the growth of alternative entertainment options and digital platforms.

A wealth of content for the Hindi speaking market available on free TV.