Vodafone Idea’s Rs 18,000-crore FPO will soon have an anchor lock-in of 50% and the shares that were listed on April 25. The top investors include GQG Partners and Fidelity.

This event has attracted a lot of attention in the Indian stock market as it may have a short-term impact on VI’s stock price.

Investors of Vi stock

Anchor investors (usually large institutional investors) play a key role in FPOs by subscribing to a predetermined portion of the offering and agreeing to hold these shares for a specific lock-up period.

In the case of VI, the anchor investor has been allocated his 50% of his total FPO issue, suggesting a large exposure from these institutional investors.

This strategy is often used to instill confidence throughout the market and ensure success for FPOs.

The participation of prominent anchor investors such as GQG Partners and Fidelity further strengthened VI’s FPO as an indication of their commitment to VI’s long-term potential and creditworthiness.

Monthly charts of Vi

According to the monthly chart, the Vodafone Idea share price has formed a base around the 10.50-11.75 level and seems to have managed to close above the key resistance level at 14.05.

Overhead resistance levels are near 18.40 and 20.00-22.00, which are potential targets for the stock price next year.

Prashanth Tapse, research analyst and senior vice president of research at Mehta Equities, said the drop towards 14-14.50 should present a good buying opportunity for the stock at this point.

VI’s FPO, which closed in April 2024, marked a significant milestone for the operator, with an ambitious target of Rs 18,000 crore, the FPO aimed to address several key areas.

First, the funds raised will be used to expand VI’s network infrastructure.

This is an important consideration in today’s telecommunications environment, where robust and scalable networks are essential to providing high-quality service to a growing subscriber base.

By modernizing and expanding our network infrastructure, VI can meet the ever-increasing demand for data and connectivity.

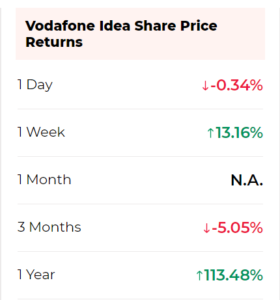

Impact on Share Price

As the 30-day lock-in period expires today, market analysts are keenly observing VI’s share price movement. Historically, the expiry of such lock-in periods can sometimes lead to selling pressure from anchor investors who may choose to exit their positions to capture short-term gains or rebalance their portfolios.

This selling pressure, if significant, could cause a temporary dip in VI’s share price. The extent of this dip would depend on several factors, such as the overall market conditions, the liquidity available in the stock, and the demand from other investors.

However, it’s important to remember that anchor investors also consider VI’s long-term prospects when making their decisions.

Additionally, other investors who were unable to participate in the FPO may be eager to buy shares once the lock-in period expires, potentially mitigating any selling pressure from anchor investors.

Vodafone Idea FPO anchor investors

Vodafone Idea’s (VI) FPO garnered significant interest from prominent anchor investors, playing a key role in the success of the offering.

The participation of these esteemed anchor investors, both domestic and international, played a crucial role in VI’s FPO.

Their substantial investments not only helped raise the targeted capital but also instilled confidence in the broader market.

This positive sentiment likely encouraged other investors to participate in the FPO, contributing to its success.

Vodafone Idea- Road Ahead

Vodafone Idea (VI) has been in the news for its recent Rs 18,000 crore FPO and the upcoming expiry of the anchor lock-in period. While these developments are significant, the bigger question lies in VI’s long-term future.

At Vodafone Idea, Mohit Gulati corrected Peter Kreeft’s words: Vodafone Idea is Dead and Alive!

Gulati said the company has recovered from the moribund and that a 15-20 per cent tariff hike for all industry players will be implemented until a solution for adjusted gross sales is found.

He said he was in a perfect, bolt-from-the-blue scenario that was just around the corner. (AGR). Finally, even though the company is the only carrier that has not introduced 5G, there is still a large brand recall among customers who support the company.

“He strongly believes that in a country as big as India, we need more than one telecom company. We will do everything possible to make this happen instead of going back to ventilators!” Mohit he added.

Vi revealed that it is in talks with Ericsson and other providers for 5G network equipment.

Comments 1