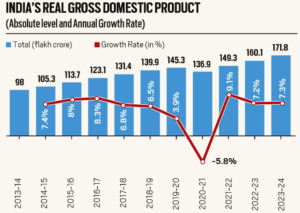

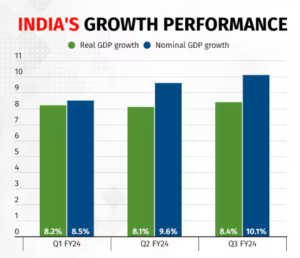

India’s GDP is projected to grow by 7.4% in Q4 FY24 and 8% in FY24. Both urban and rural indicators point to strong economic dynamism, with business performance improving estimated by SBI reports.

Reports regarding India’s GDP

The Reserve Bank of India (RBI) expects real GDP growth to be 7.3 per cent in Q4FY24, 7.5 per cent in Q1FY25 and 7.0 per cent for the full year 2025. Principal Economic Adviser V Ananta Nageswaran had also earlier said that India’s economic growth is very likely to reach 8 per cent in FY24.

“Early indicators point to long-term urban and rural growth trends, with the gradual growth of the rural economy accelerating.

The percentage of indicators indicating acceleration has remained above 80 since January 2024, with urban indicators showing significant improvement in recent months. Passenger vehicle sales, passenger traffic at airports, GST collections, credit card transactions, petroleum consumption and toll collections all point to improving urban economic dynamics,” the report said.

Urban and Rural Economic Indicators

SBI Research highlights long-term growth trends in both urban and rural areas. Over 80% of leading indicators have shown acceleration since January 2024, especially in urban areas.

Indicators such as vehicle sales, airport traffic, GST collections, credit card transactions, petrol consumption and toll revenues point to growing economic vitality in cities.

The rural economy is also showing positive signs, with the share of accelerating indicators increasing from 56% in February 2024 to 75% in March 2024.

Leading indicators such as diesel consumption and two-wheeler sales have been increasing, reflecting growing rural economic activity.

It was also stated that the rural economy is gradually recovering. In March 2024, 75% of the indicators showed growth, compared to 56% in February and 60% in January.

Meanwhile, GDP growth in the December quarter rose 8.4%, the highest in six quarters, indicating India’s economic performance and the resilience of India’s finances.

GDP Growth and Global Outlook

The report highlighted that despite geopolitical and extreme weather risks, global economic growth remains robust, inflationary pressures are easing and employment conditions are tight.

Global headline inflation is expected to decline from an average of 6.8% in 2023 to 5.9% in 2024 and then to 4.5% in 2025, with advanced economies returning to inflation target sooner than emerging and developing countries.

Corporate Performance

Corporate performance drives a country’s GDP. High corporate profits and sales growth lead to increased economic activity, which is reflected in a healthy GDP.

Government spending can directly benefit businesses. Conversely, inflation can squeeze profit margins and a local economic downturn can hurt demand.

While GDP provides a national perspective, businesses manage their performance through CPM (corporate performance management).

This involves setting goals, tracking progress against the indicators, and adjusting strategies as needed. Financial indicators such as sales are important, but non-financial indicators such as customer satisfaction also play a key role. Understanding both national and corporate performance is essential to building a robust and sustainable economy.

FY 2023-24

India’s GDP growth rate for FY24 is estimated at 7.6%, driven by government spending and strong manufacturing. However, slowing rural demand and inflation pose challenges, with experts forecasting growth of 6.2% to 7.4% in Q4 FY24.

The government needs to address rural demand and inflation to maintain a healthy growth trajectory.

Future India

The official GDP data for Q4 FY24, to be released by the National Statistical Office (NSO) on 31 May 2024, will provide a clearer picture of India’s economic performance.

Measures to improve farm incomes and support rural infrastructure development are essential to revitalize rural consumption. This could include initiatives such as minimum support prices for crops, increased crop diversification and improved irrigation facilities. Investments in rural roads, storage facilities and access to markets will also help mitigate post-harvest losses and improve farmer incomes.

Controlling inflation through effective monetary policy and supply-side interventions is essential to stabilise private consumption and support economic growth.

Promoting exports through trade facilitation will help India leverage global opportunities and mitigate the risks associated with slowing domestic demand. This could include streamlining trade procedures, reducing regulatory hurdles and negotiating favorable trade agreements.

Additionally, efforts to increase India’s export competitiveness through skill development and technological advancements will also be beneficial. India’s economic development in FY2025 will depend on the government’s ability to address these challenges and leverage existing growth drivers.

Maintaining a healthy balance between growth and inflation is critical to ensuring economic stability and long-term prosperity. The government‘s focus on driving infrastructure development, digitalization and innovation will also play a key role in shaping India’s future economic growth trajectory.

Comments 1