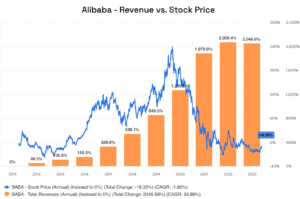

Alibaba shares fall 6 percent after the Chinese tech giant lost 86 percent of its value in FY24 Q4 results on Tuesday. Alibaba appeared poised to test its 200-day moving average. Shouting out and confirming funding levels would put Alibaba in the zone of expansion.

This sharp decline comes despite the headline profit figure, which reflects an 86% year-over-year drop in net income attributable to ordinary shareholders.

Alibaba Group Holding Limited

Eddie Wu‘s company Alibaba was all over the news on Tuesday as the share price of the company falls after Fiscal Q4 Results. Alibaba is a Chinese multinational technology company specializing in e-commerce, retail, Internet, and technology.

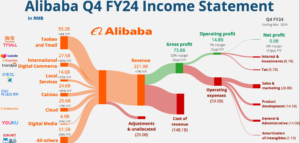

Alibaba posted a beat on revenue in its fiscal fourth quarter ended in March, but the Chinese e-commerce giant’s net profit plunged. However, a jarring plunge in net income set off alarm bells, leaving investors to scramble.

Share Price Plunges Despite Fiscal Q4 Profit

Chinese e-commerce giant Alibaba experienced a sharp decline in the stock market after announcing its fourth quarter fiscal 2024 results. Despite gross profits of $1.7 billion, the company’s stock price fell an astounding 6%.

Investors crushed Alibaba shares on Tuesday morning despite weak profits. Investors focus instead on losses. Alibaba primarily blamed its investment portfolio for the decline.

The company reported a “net loss on investments in publicly traded companies for the quarter,” compared to net income in the same period last year.

The change is likely due to a “mark-to-market change,” suggesting that the current market value of Alibaba’s investments is below the purchase price.

Alibaba had a tumultous FY24

Alibaba has had a difficult year in 2023, implementing its largest corporate restructuring to date. Additionally, several high-profile executive changes were made, with company veteran Eddie Wu taking the helm as CEO in September.

In a show of confidence to shareholders, the Chinese tech giant announced earlier this year that it would increase its share buyback program by $25 billion until the end of March 2027. Alibaba has struggled with cautious consumer spending in China, but its core e-commerce business showed signs of gradual recovery in the March quarter.

The Hangzhou-based company faces increasing competition from low-cost companies such as PDD, Alibaba ramps up its overseas operations amid the domestic economic downturn.

Alibaba’s focus on future AI

Alibaba’s CEO, Eddie Wu, tried to project confidence in the company’s future, stating, “This quarter’s results demonstrate that our strategies are working and we are returning to growth”. However, the substantial profit decline cast a long shadow, raising concerns among investors and triggering the stock price plunge.

While the substantial profit decline is a cause for concern, Alibaba’s emphasis on AI could be a positive indicator for its long-term prospects. The coming quarters will be crucial for Alibaba as it strives to regain investor confidence, navigate the challenges of a volatile market, and capitalize on its AI advancements.

Alibaba stated “AI-related revenue was generated from various sectors including foundational model companies, internet companies, as well as customers from industries such as financial services and automotive,” which simply implies that the company is focusing on future AI.