Introduction

Over the last ten years, the world has become more connected and advanced technology has created challenges to prevent tax evasion.

To deal with this issue, countries worldwide shared bank information and established a minimum tax for large international companies. But it’s not clear how well these efforts are working. There are still worries that companies are finding ways to avoid paying taxes.

The EU Tax Observatory presents the Global Tax Evasion Report 2024, authored by Annette Alstadsaeter, Sarah Godar, Panayiotis Nicolaides, and Gabriel Zucman. This independent research lab acknowledges funding support from the European Union.

The Global Tax Evasion 2024 report strives to shed light on these issues by consolidating scientific evidence from over 100 researchers worldwide. Despite data imperfections, the report seeks to democratise knowledge on global tax evasion dynamics, underlining the need for more extensive public statistics on corporate profits, wealth and effective tax rates.

The report unveils six critical insights into international tax evasion and competition dynamics. It presents six recommendations to address the identified issues, which we’ll now summarise.

Finding 1: A Real Breakthrough : The Automatic Information Exchange

This demonstrates that the automatic exchange of bank information has been a game-changer, reducing offshore tax evasion by almost threefold in less than a decade.

Earlier, around 10% of the world’s financial wealth in tax havens, largely undisclosed to tax authorities and owned by the affluent, has now seen a significant drop in non-compliance to about 25%.

However, despite this progress, some challenges persist.

Firstly, certain financial assets can still flee reporting due to non-compliance by offshore institutions or limitations in the automatic exchange system. While many comply, some fear losing customers and face little threat from foreign tax authorities. Secondly, not all assets fall under this exchange, allowing people to manipulate loopholes by shifting assets into non-covered areas like real estate.

Finding 2: Profits Fleeing to Tax Havens—Policy Impact Unclear

Despite efforts, $1 trillion in profits was funnelled into tax havens in 2022, equivalent to 35% of all profits generated by multinational companies beyond their home country.

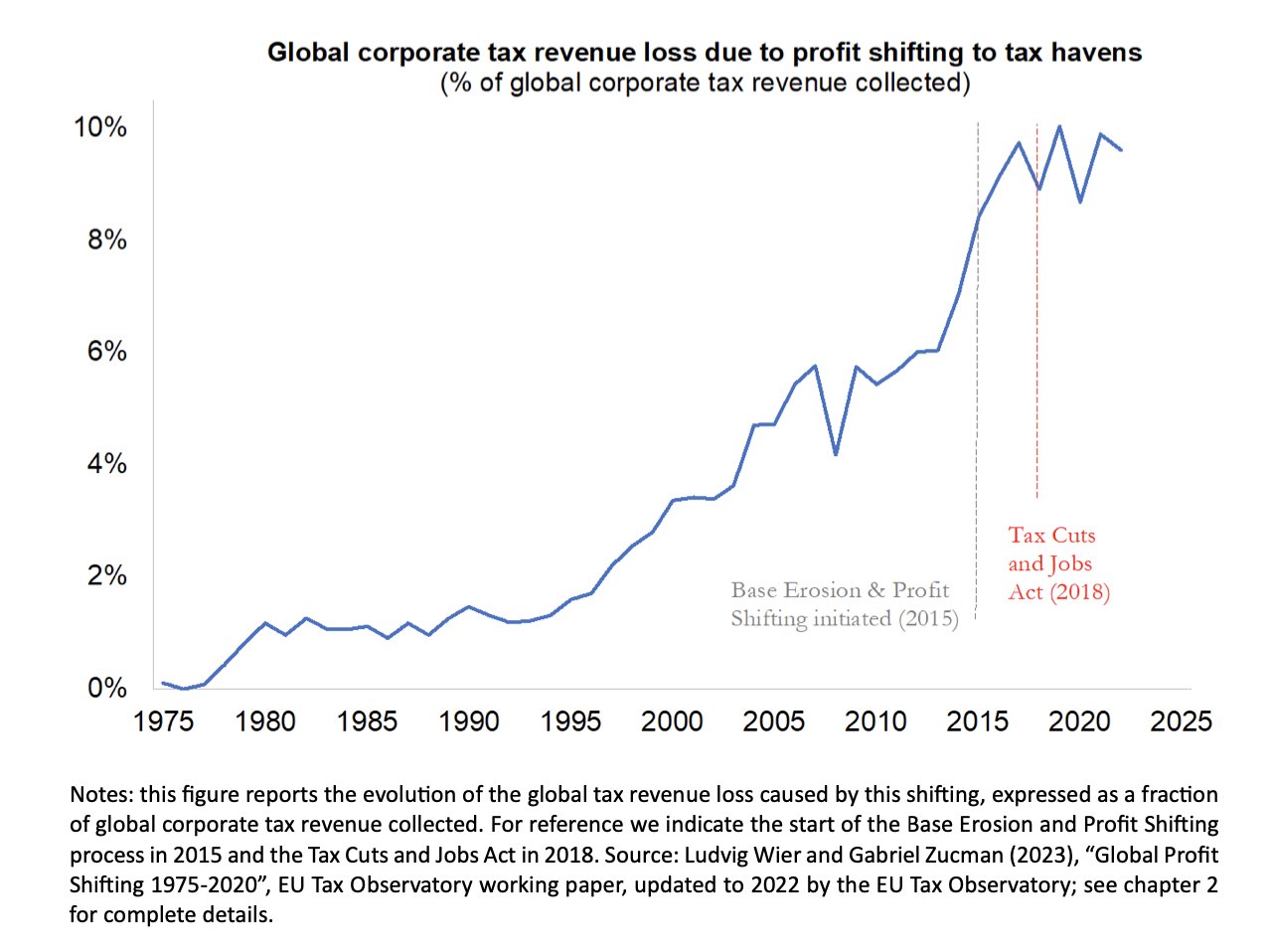

This profit shifting resulted in considerable corporate tax revenue losses globally, amounting to nearly 10% of total corporate tax revenues. Strikingly, U.S. multinationals contribute around 40% to this global profit shifting, and European countries, particularly Continental ones, bear the brunt of this evasion.

Despite ambitious policy endeavours such as the OECD’s Base Erosion and Profit Shifting (BEPS) established in 2015 and U.S. measures introduced in 2017, including a corporate tax rate cut, global profit shifting has seen only borderline changes over the past seven years.

The loss of tax revenue due to this shifting remains stagnant at about 10% of global corporate tax revenue. While these policies have likely prevented even higher levels of profit shifting, they haven’t exceptionally constrained the practice.

Finding 3: The global minimum tax has dramatically weakened

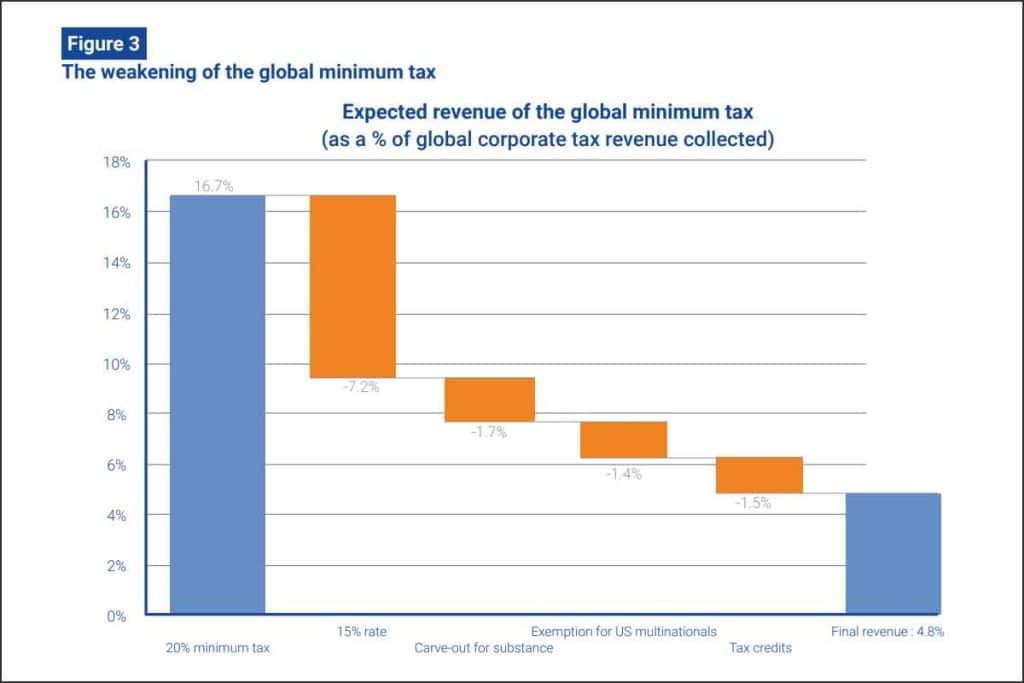

In a groundbreaking move in 2021, over 140 countries and territories agreed to initiate a historic minimum tax of 15% on multinational profits—a significant divergence from previous endeavours that concentrated on regulating the tax base without addressing the paramount factor of tax rates.

Nonetheless, since this political accord, the effectiveness of the global minimum tax has been harshly compromised by a growing array of loopholes.

In its current state, the minimum tax is projected to yield only a fraction of the expected revenue, amounting to less than 5% of global corporate income tax revenue compared to the anticipated 9% with a 15% rate and no loopholes, or over 16% with a 20% tax rate.

Again, there’s a disconcerting aspect as the global minimum tax still permits a race-to-the-bottom scenario with corporate taxes, enabling companies to maintain effective tax rates below 15% if they conduct sufficient activity in low-tax nations.

Finding 4: Emerging Tax Battles Impacting Revenue and Inequality

The ongoing subsidies race for green-energy producers may more than offset the revenue gains from the global minimum corporate tax. Triggered by the multiplication of Chinese state aid and the Inflation Reduction Act in the United States, governments worldwide are increasingly offering subsidies to producers of green energy.

This race is more desirable than standard tax competition (reducing the tax rate for all corporate profits) because it has a crucial positive-sum aspect: it can accelerate the transition to a zero-carbon global economy.

But it also raises some of the same issues as standard tax competition. It depletes government revenues, and if not accompanied by egalitarian measures, it risks increasing inequality by boosting the after-tax profits of shareholders, who tend to be towards the top of the income distribution.

Finding 5: Global billionaires benefit from meagre effective tax rates

Pioneering research completed in collaboration with tax administrations displays that global billionaires brag about sparse personal effective tax rates, varying from 0% to 0.5% of their wealth.

In the United States, billionaires’ effective personal tax rate hovers around 0.5%, while it leans closer to 0% in France.

A critical reason for billionaires’ meagre effective tax rates in numerous countries is their ability to utilise personal wealth-holding companies to sidestep income taxes.

In these nations, employing a holding company enables wealthy owners of publicly listed corporations distributing dividends to evade taxes on these dividends.

Notably, countries like the United States do not tolerate this practice and automatically subject dividends earned through personal holding companies to income tax.

Finding 6: A global minimum tax on billionaires would raise large sums

This emphasises that a global minimum tax on billionaires, set at 2% of their wealth, could combat this evasion and yield almost $250 billion from fewer than 3,000 individuals.

This proposal, detailed and quantified for the first time to the authors’ knowledge, handles a gap that was difficult to fill without data on the existing tax payments of billionaires.

Although the number of taxpayers affected is minimal, and the proposed tax rate (2%) is mediocre—especially considering the annual 7% growth in the wealth of global billionaires since 1995—the revenue prospect remains substantial, given the wealth concentration at the top and the now low tax rates for billionaires.

Six Ways to Harmonise Globalisation with Tax Equity

The report provides six recommendations to attack identified issues, all centring on decreasing the tax deficit of multinational companies and affluent individuals. The proposals from the report are as follows:

1. Reform the global agreement on minimum corporate taxation to implement a rate of 25% and dismiss the loopholes that foster tax competition.

2. Present a new global minimum tax for billionaires equal to 2% of their wealth.

3. Institute mechanisms to tax wealthy people who have been long-term citizens in a country and decide to move to a low-tax country.

4. Execute unilateral measures to collect some of the tax deficits of multinational companies and billionaires in case global agreements on these issues fail.

5. Move towards developing a Global Asset Registry to fight tax evasion better.

6. Strengthen the application of economic substance and anti-abuse laws.

Conclusion

In conclusion, the Global Tax Evasion 2024 report discloses critical insights into international tax dynamics, highlighting challenges and proposing six recommendations. The report underscores the need for comprehensive reforms. Despite challenges, enforcing these recommendations could generate substantial revenue and contribute to a more equitable global tax system amid the intricacies of globalisation.

If you found this report insightful, you may also like :

AI’s 15 Trillion-Dollar Triumph: Pwc Study