Coal imports by India registered significant growth of 27.2% in December 2023 compared to the same period last year. As India aims to end dependence on imported thermal coal by 2026, the jump in imports has raised doubts over the achievability of the target.

Total Imports Hit 23.35 Million Tonnes

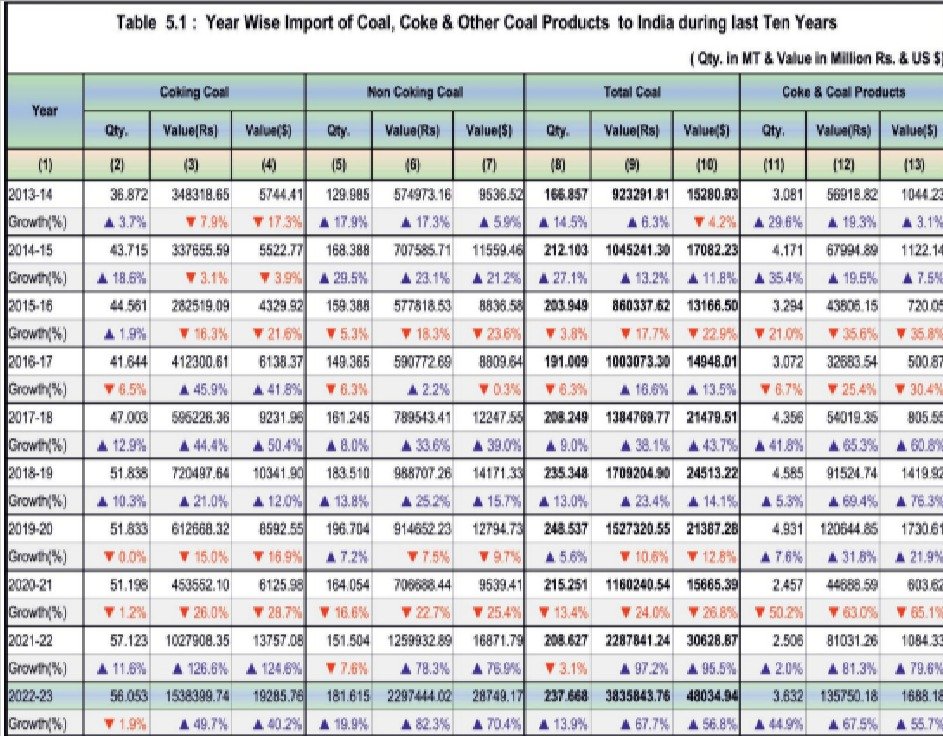

As per statistics compiled by mjunction services ltd, a B2B e-commerce firm, India imported 23.35 Million Tonnes (MT) of coal in December 2023.

This reflects a considerable 27.2% increase over December 2022. Of the total imports in December 2023, non-coking coal made up the largest share at 15.47 MT, nearly 46% higher compared to the 10.61 MT imported in December 2022.

Coking coal imports were 4.84 MT in December 2023, up from 4.71 MT in December 2022.

In the cumulative period of April-December 2023, India’s total coal import rose marginally to 192.43 MT, compared to 191.82 MT during the same period in 2022. Non-coking coal made up the majority at 124.37 MT, while coking coal amounted to 42.81 MT.

What’s Driving India’s Persistent Coal Import Growth?

The report does not clearly specify the reasons behind the continued growth in coal imports. It seems to be driven by a supply-demand gap, as India remains heavily reliant on imported coal despite being one of the world’s top producers.

Likely factors influencing imports include pace of domestic coal production, power and industrial sector coal demand, global coal price trends making imports economical, infrastructure bottlenecks in coal transportation and inventory management.

Impact on Goals to Phase Out Thermal Coal Imports

The 27% import growth rate in December 2023 is noteworthy as India aims to end thermal coal imports completely by 2026. With coal projected to remain India’s mainstay fuel for the next two decades, stakeholders feel a strong boost in domestic coal production is crucial to achieve this goal. The cost competitiveness of imported coal also remains a key factor.

Despite logistical challenges, landed prices of imported coal sometimes still work out cheaper compared to domestic supply. This continues to make imports attractive for coastal power plants.

Wider Implications of Continued Coal Import Reliance

As a developing economy with huge energy needs, India straddles a fine balance between environmental considerations and developmental requirements. The country’s long-term import reliance for coal, despite self-sufficiency goals, has wider implications on macroeconomic stability as well as global climate change targets.

Managing external risks from global coal supply-demand dynamics and price volatility remains a policy imperative. Environmentally, India also needs a strategy to balance coal’s role in its energy mix with larger net zero commitments.

The December 2023 import growth data underscores these structural conundrums facing energy policymakers.

Read about how Reliance becomes first Indian company to hit ₹20 Lakh Crore Market Cap

Comments 2