The ongoing negotiations for the Free Trade Agreement (FTA) between India and the European Free Trade Association (EFTA) have stirred up a storm, with a particular ‘data exclusivity’ clause at the heart of the debate. This clause, if accepted, could ripple through India’s robust generic drug industry, potentially altering its landscape.

On February 15, 2024, Sunil Barthwal, the Secretary of the Department of Commerce in India’s Ministry of Commerce & Industry, made a pivotal declaration. In a media interaction, he voiced India’s steadfast refusal to bow down to the ‘data exclusivity’ demand in the proposed FTA with the EFTA. His words echoed India’s unwavering allegiance to its generic drug industry, a commitment that wouldn’t be compromised in any trade agreements. This proclamation stands as a testament to India’s determination to shield its interests and champion its flourishing generic drug industry.

Sticking Point: Data Exclusivity

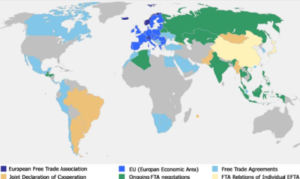

The European Free Trade Association (EFTA), a group that includes Iceland, Liechtenstein, Norway, and Switzerland, is currently in trade talks with India. A significant hurdle in these discussions is the demand for data exclusivity. This provision safeguards the technical data that pioneering companies generate to validate the effectiveness of their products. In the realm of pharmaceuticals, this could mean that drug companies could prevent their rivals from obtaining marketing licenses for economical versions during the exclusivity period.

India’s Resolute Support for Generic Drug

Sunil Barthwal has unequivocally stated that India will not undermine the interests of the generic drug industry in any Free Trade Agreement. “They want there to be data exclusivity, we rejected their demand. We are with our generic industry,” he affirmed. His proclamation highlights India’s steadfast commitment to its generic drug industry, a sector that is valued at about USD 25 billion and exports half of its output.

India, which houses the third-largest pharma industry worldwide, has categorically rejected the EFTA’s demand. Commerce Secretary Sunil Barthwal assured that the interests of the generic drug industry would be safeguarded in all FTAs being negotiated. India’s generic drug industry, a significant contributor to the country’s growth, manufactures about 60,000 generic brands across 60 therapeutic categories and accounts for 20% of the global supply of generics. The industry’s success story is epitomized by its role in providing affordable HIV treatment globally.

Potential Consequences of Data Exclusivity

The data exclusivity clause goes beyond the provisions of the Trade-Related Aspects of Intellectual Property Rights (TRIPS) agreement under the World Trade Organisation. If agreed upon, it could have profound implications for India’s generic drug industry, potentially postponing the introduction of affordable, generic versions of patented drugs.

Controversial ‘Data Exclusivity’ Clause

The EFTA bloc proposed the inclusion of a ‘data exclusivity’ provision in the FTA. This drug clause safeguards the clinical trial data of a pharmaceutical company for a specific drug, thereby prolonging the monopoly for the original drug. Generic competitors would be barred from applying for regulatory approval for equivalent drugs using the originator’s data for years. This could delay access to affordable, generic versions of patented drugs in India by a minimum of six years.

The ongoing FTA negotiations underscore the intricate balancing act between safeguarding domestic industries and nurturing international trade relationships. As India skillfully navigates these complex dynamics, the world is watching closely. The outcome will not only mold the future of India’s generic drug industry but also set a benchmark for other developing nations grappling with similar challenges.

Looking Ahead

India’s refusal to accept the ‘data exclusivity’ clause is a strong affirmation of its dedication to its generic drug industry. Yet, India is also in the midst of advanced negotiations for an FTA with the UK and parallel discussions with the EU. Both these entities are pushing for India to extend beyond its commitments under the multilateral TRIPS agreement and offer more concessions to big pharmaceutical companies. The outcomes of these negotiations will undoubtedly have a significant impact on the future trajectory of India’s generic drug industry.