China’s stock market modestly decreased on Friday, 31 May 2024, as hazard sentiments weight down after an professional manufacturing facility survey confirmed the country`s production hobby abruptly shrunk in May.

However, marketplace losses capped because the weakening in Chinese manufacturing facility and non-production sports stored alive requires sparkling stimulus to reinforce the economy.

At near of trade, the benchmark Shanghai Composite index declined through 0.16%, or 4.86 points, to 3,086.81. The Shenzhen Composite Index, which tracks shares on China’s 2d exchange, edged up 0.2%, or 3.fifty three points, to 1,729.65. The blue-chip CSI300 index reduced through 0.4%, or 14.39 points, to 3,579.65.

Index Rates of China Stock Market

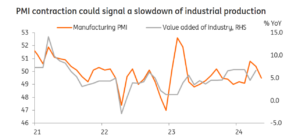

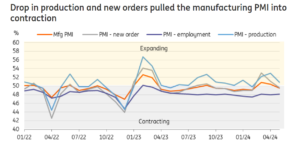

The manufacturing purchasing managers’ index, a widely followed gauge of factory activity, fell to 49.5 in May from 50.4 in April.

It was the first time the sector has contracted since March and dipped below the 50 mark that separates growth from decline. Analysts had expected a slight rise to 50.4.

The news triggered a wave of risk aversion in the market. The Shanghai Composite Index ended down 0.16 percent, or 4.86 points, at 3,086.81. But the broader Shenzhen Composite Index edged up 0.2 percent, or 3.53 points, to 1,729.65.

Hong Kong’s Hang Seng Index, which is heavily influenced by mainland Chinese companies, also fell, dropping 150.58 points (0.83%) to 18,079.61, extending its decline from the previous week.

Dissecting the Data of the Chinese Market

The PMI report revealed a worrying decline in new orders for both domestic and export orders, suggesting that the slowdown in demand may spread to various industries. Notably, export orders fell back into contraction territory at 48.3, suggesting that Chinese manufacturers may be struggling to remain competitive in the global market.

Continuing trade tensions with the US and economic slowdowns in major countries may contribute to this. While the manufacturing PMI contracted, the non-manufacturing PMI, which measures activity in the service sector, remained in expansion territory at 51.1, albeit at the slowest pace since January 2024.

But the subcategory of the non-manufacturing PMI paints a worrying picture. Services sector orders continued to decline, pointing to weak consumer spending. The employment in the sector also fell, raising concerns about job growth.

Investors and Policy Response

The weak PMI data has created nervousness among investors concerned about the health of the Chinese economy.

Recent COVID-19 lockdowns in major cities such as Shanghai have added to these concerns, disrupting supply chains and slowing economic activity.

Analysts believe the Chinese government may be forced to introduce additional stimulus measures to stimulate the economy.

This could include more infrastructure spending, corporate tax cuts and liquidity injections into the financial system.

“The disappointing PMI data is a wake-up call for the Chinese government,” said Li Wei, an economist at Peking University. “They must act decisively to prevent a further deterioration of the economy.”

A Balancing Act

The Chinese authorities faces a sensitive balancing act. On the only hand, it wishes to stimulate increase to save you a full-size monetary slowdown.

This ought to contain focused measures to enhance precise sectors, consisting of infrastructure spending or tax breaks for small and medium-sized enterprises.

The authorities can also loosen credit score regulations on agencies to inspire borrowing and investment. However, the authorities have to additionally have in mind of the capacity for growing inflation.

The People`s Bank of China (PBOC) has thus far kept away from elevating hobby costs aggressively, not like many different critical banks across the world.

This is in all likelihood because of worries approximately stifling monetary increase. However, growing inflation ought to pressure the PBOC to tighten financial coverage withinside the coming months, in addition complicating the monetary outlook.

Global Repercussions

A slowdown in the Chinese economy would have significant repercussions for the global economy. China is a major exporter and importer of goods, and a slowdown in its growth could disrupt global supply chains and dampen demand for commodities. This, in turn, could lead to lower economic growth and higher unemployment in other countries.

The weak PMI data casts a shadow over China’s economic outlook. Although the government has the resources to spur growth, it faces several challenges, including rising inflation and ongoing geopolitical tensions.

The coming months will be crucial in determining how the Chinese government responds to these challenges and whether it can avoid a sharp slowdown in the world’s second-largest economy.