MUMBAI, Feb 13: Reliance Industries Ltd (RIL), owned by billionaire Mukesh Ambani, created history on Tuesday by becoming the first Indian company to cross ₹20 lakh crore ($262 billion) in market capitalization. This milestone marks a significant achievement for corporate India and RIL’s emergence as a global industry leader in multiple sectors.

RIL has significantly contributed to India’s economy over the years. Its energy business is one of the largest integrated energy companies globally, and its digital subsidiary, Jio, has transformed India’s digital infrastructure by offering affordable internet services.

RIL’s retail division operates over 12,000 stores across India, and its focus on research and development has led to innovations in various fields. As a major employer, RIL has created numerous employment opportunities, contributing to India’s socio-economic development.

RIL’s retail division operates over 12,000 stores across India, and its focus on research and development has led to innovations in various fields. As a major employer, RIL has created numerous employment opportunities, contributing to India’s socio-economic development.

Furthermore, RIL’s growth has boosted India’s economy and played a pivotal role in the country’s digital transformation, retail revolution, and energy security.

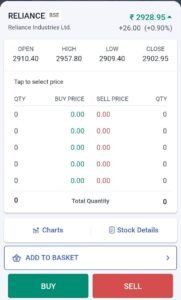

Reliance Share Price Surges to All-Time High

RIL’s share price hit an all-time high of ₹2,958 on the Bombay Stock Exchange, rising by 1.88% during Tuesday’s morning trading session. This price surge led to RIL’s market valuation crossing the ₹20 lakh crore mark intraday, before closing at ₹19.9 lakh crore.

Analysts have attributed this valuation to strong and sustained fundamentals across RIL’s business verticals. The company has posted robust growth in recent quarters across its digital, retail and legacy oil-to-chemicals verticals.

This demonstrated execution capacity has improved investor confidence in RIL’s corporate governance and future growth runway.

Successful Diversification Into Consumer Businesses

According to market experts, RIL’s success can be attributed to its strategic diversification from an oil & gas company into emerging high-growth sectors like digital services and organized retail.

Over the past 5-6 years, RIL has invested over $40 billion to build market-leading consumer businesses like Jio Platforms and Reliance Retail.

Today, these consumer businesses contribute over 50% to RIL’s earnings.

This successful diversification has opened strong new revenue channels for RIL, reducing its dependence on legacy oil refining and petrochemicals businesses.

Strong Growth Prospects on Data and Retail Boom

RIL is seen as a structural growth story in India, given its leadership in connectivity platforms and organized retail – two of India’s fastest growing sectors.

With the advent of 5G services and accelerating data demand, RIL’s digital arm Jio Platforms is poised for massive growth as it continues to acquire new subscribers. Similarly, Reliance Retail is benefiting from rising incomes and consumption across India.

These strong growth prospects across its core business verticals make RIL a favourite pick for long-term investors.

Boost to Mukesh Ambani’s Fortune

The surge in RIL’s market cap has significantly boosted founder & chairman Mukesh Ambani’s fortunes. At $109 billion, Ambani is currently the richest Indian and ranks 11th globally on the Bloomberg Billionaires Index.

In fact, the recent run-up has made Ambani richer by almost $20 billion year-to-date in 2024 alone. He has added nearly $90 billion to his net worth since March 2020, underscoring value creation at India’s most valued company.

Valuation Growth Over the Years

Over the past two weeks alone, RIL’s market value has grown by over ₹1 lakh crore, reflecting the market’s confidence in its future outlook.

To put RIL’s growth in perspective, the company first hit a market cap of ₹1 lakh crore in August 2005. This was followed by ₹10 lakh crore in November 2019, on the back of RIL’s new age consumer businesses.

The latest ₹20 lakh crore milestone reinforces RIL’s position as the most valued company in India by a wide margin. RIL is now ahead of other bluechip companies like TCS, HDFC Bank, ICICI Bank and Infosys in terms of market capitalization.

RIL’s ₹20 lakh crore market cap demonstrates the success of India’s leading conglomerate across both traditional and emerging businesses. Chairman Mukesh Ambani’s vision to transform RIL from an old economy company to a technology, consumer and digital services leader has borne fruit.

The company is now poised for strong sustained growth and value creation as India’s economy expands. For Indian equity markets, RIL is likely to remain a key index leader given its weightage and future outlook.

Read about Cisco’s massive layoffs to cut 1000s of jobs for high-growth focus

Comments 1